Learn how to use the Average Directional Index (ADX) to spot strong trends and boost your trading strategy for higher profits.

The Average Directional Index (Average Directional Index) is a powerful tool for identifying the strength of trends in financial markets. Whether you’re a seasoned trader or just starting, understanding and utilizing the Average Directional Index can improve your ability to spot strong trends, make better trading decisions, and ultimately boost your profits. In this comprehensive guide, we’ll break down everything you need to know about the Average Directional Index, including its components, how to use it, and advanced strategies for maximizing its effectiveness.

What is the Average Directional Index?

The Average Directional Index (Average Directional Index) is a technical indicator created by J. Welles Wilder in 1978. It measures the strength of a trend, helping traders assess whether a market is trending or moving sideways. Unlike other indicators that show the direction of a trend (up or down), the Average Directional Index focuses purely on the trend’s strength.

Key Components of Average Directional Index

- +DI (Positive Directional Indicator): This line shows the strength of upward price movement.

- -DI (Negative Directional Indicator): This line shows the strength of downward price movement.

- Average Directional Index (Average Directional Index): The main line, which indicates the strength of the trend regardless of whether it is an uptrend or downtrend.

The Average Directional Index is plotted on a scale from 0 to 100. Values above 25 typically indicate a strong trend, while values below 20 suggest a weak or sideways market.

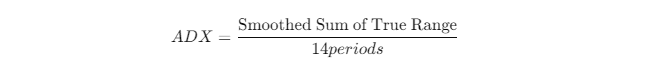

How Does Average Directional Index Work? Understanding the Formula

The Average Directional Index calculation is based on the difference between the +DI and -DI indicators, as well as the True Range (TR) of the market. It uses a smoothing formula over a given period, usually 14 periods, to provide a clear indication of trend strength.

Average Directional Index Formula::

This formula helps smooth out the fluctuations and provides a clearer indication of the underlying trend strength.

Average Directional Index Values:

- 0-25: Indicates no trend or a weak trend.

- 25-50: Signals a moderate to strong trend.

- 50-75: Strong trend, market is trending decisively.

- 75-100: Very strong trend, market is trending with high volatility.

Traders use these values to decide when to enter or exit a trade based on market conditions.

When and How Should You Use Average Directional Index for Trading?

The key to successfully trading with the Average Directional Index is knowing when to use it and how to interpret the readings. Here’s how you can incorporate the Average Directional Index into your strategy.

Key Average Directional Index Readings:

- Below 20: The Average Directional Index below 20 signals a lack of a trend. The market is moving sideways, and trend-following strategies should be avoided.

- 20-40: A market is in the process of forming a trend, but it is still developing. This is an ideal time to look for trend confirmation and cautiously enter trades.

- Above 40: Strong trends are in place, making this the best time for trend-following trades. The trend is robust, and it’s easier to make profitable trades in this condition.

Identifying the Right Market Conditions:

- Range-bound markets: When the Average Directional Index is below 20, it’s a good idea to stay out of the market since trends are weak.

- Trending markets: When the Average Directional Index crosses above 25, a strong trend is developing. You can enter trades based on the direction of the trend (bullish or bearish).

- Confirming market reversals: When the Average Directional Index rises and then begins to fall, it might signal the end of a trend. This is an early signal that a reversal may be occurring.

By understanding the Average Directional Index readings, you can adapt your strategy to the current market conditions, improving your trade entries and exits.

Can Average Directional Index Be Used Alone?

While the Average Directional Index is a powerful indicator for identifying trend strength, it does not give you direction (up or down) of the trend. To trade successfully, you need to combine the Average Directional Index with other indicators that provide directional information.

Combining Average Directional Index with Other Indicators

- +DI and -DI Indicators: These indicators show the direction of the trend. When the +DI is above the -DI, it signals an uptrend. When -DI is above +DI, it indicates a downtrend.

- Moving Averages: Combining the Average Directional Index with moving averages helps confirm the direction of the trend. A crossover of a short-term moving average above a long-term moving average indicates a bullish trend.

- Relative Strength Index (RSI): Use RSI to identify overbought or oversold conditions, helping you avoid entering the market at extreme price levels.

Step-by-Step Guide to Trading with Average Directional Index

Using the Average Directional Index effectively involves more than just observing the readings; it requires an understanding of when to enter and exit the market. Here’s a step-by-step guide to trading with the Average Directional Index.

1. Set Up Average Directional Index on Your Trading Platform

Most trading platforms, such as MetaTrader, TradingView, or ThinkOrSwim, offer the Average Directional Index as a built-in indicator. Simply add it to your chart to start tracking trends.

2. Choose Your Timeframe

Depending on your trading style, you can apply the Average Directional Index to different timeframes:

- Short-term traders: Use the Average Directional Index on shorter timeframes (e.g., 5-minutes or 15-minutes) for quick entries and exits.

- Long-term traders: Apply the Average Directional Index on daily or weekly charts to capture longer-term trends.

3. Analyze the Average Directional Index Readings

Once the Average Directional Index is applied, monitor the movement of +DI, -DI, and Average Directional Index to confirm market trends:

- Average Directional Index above 25: Strong trend, look for entry opportunities.

- Average Directional Index below 20: No strong trend, avoid trend-following trades.

4. Entering Trades

When the Average Directional Index indicates a strong trend (above 25), you can use +DI and -DI to confirm the direction:

- For a long position: Enter when +DI crosses above -DI and Average Directional Index is rising.

- For a short position: Enter when -DI crosses above +DI and Average Directional Index is rising.

5. Exit Trades

Exit the trade when the Average Directional Index starts declining (below 20), signaling that the trend is weakening or reversing.

Examples of Trading with Average Directional Index: Real Market Scenarios

Let’s take a closer look at how the Average Directional Index can be applied to real market conditions using stock and forex examples.

Example 1: Stock Trading with Apple (AAPL)

- When the Average Directional Index rises above 25, this indicates the start of a bullish trend.

- Confirm the trend direction using +DI (bullish) and enter a long position.

- As the Average Directional Index continues to rise, hold the position.

- Exit when the Average Directional Index falls below 20, signaling a weakening trend.

Example 2: Forex Trading with GBP/USD

- When the Average Directional Index rises above 25, enter a long position when +DI is above -DI.

- After several periods of Average Directional Index rising, the trend becomes strong, so hold the position.

- Exit when the Average Directional Index starts declining, signaling that the bullish trend is losing strength.

These examples illustrate how the Average Directional Index helps identify and confirm strong trends, leading to better trade entries and exits.

Maximizing Profits with Average Directional Index: Advanced Strategies

For experienced traders, there are several ways to take your Average Directional Index strategy to the next level.

1. Combine Average Directional Index with Price Action

Price action trading focuses on market patterns and candlestick formations. When the Average Directional Index confirms a strong trend, look for price action signals, such as a bullish engulfing pattern during an uptrend or a bearish engulfing pattern in a downtrend.

2. Multi-Timeframe Analysis

Using the Average Directional Index across multiple timeframes can provide additional context. For instance, if the daily chart shows an uptrend (Average Directional Index above 25) and the hourly chart confirms the same trend, you have a higher probability of success.

3. Use Average Directional Index for Risk Management

- Trailing Stops: As the Average Directional Index rises, use trailing stops to lock in profits as the trend continues.

- Position Sizing: Increase position size when the Average Directional Index shows a strong, trending market and reduce position size when Average Directional Index falls below 20.

Final Thoughts: Take Your Trading to the Next Level with Average Directional Index

The Average Directional Index is an essential tool for traders who want to focus on trend strength. By incorporating the Average Directional Index into your trading strategy, you can avoid weak, range-bound markets and focus on strong, trending conditions that offer higher profit potential.

Whether you’re trading stocks, forex, or other assets, mastering the Average Directional Index and combining it with other indicators will help you make more informed decisions and optimize your trading strategy.

For more detailed insights on the Average Directional Index and how to enhance your trading with technical analysis, visit Investopedia’s Average Directional Index Guide.

Terms and Conditions

Educational Purpose

The content provided in this article is intended for informational and educational purposes only. It does not constitute financial, investment, or trading advice.

Learn how to use the Advance/Decline Indicator for market analysis, spotting trends, and improving trading strategies with our in-depth guide.