Learn how to use the Balance of Power (BoP) indicator to master trend analysis, spot reversals, and refine your trading strategy.

Understanding the Bollinger Bands %B Indicator

The Bollinger Bands %B indicator, developed by John Bollinger, is a unique technical analysis tool that quantifies the price’s relative position within Bollinger Bands. This versatile indicator simplifies market analysis, making it easier for traders to interpret price movements and volatility. Unlike traditional Bollinger Bands, which display the upper, middle, and lower bands on a chart, the %B indicator translates this information into a single, easy-to-read value.

The beauty of the %B indicator lies in its ability to provide actionable insights into market conditions. It helps traders identify overbought and oversold zones, spot trends, anticipate reversals, and even detect breakout opportunities. By offering a more granular perspective of price action within the bands, the %B indicator becomes an essential tool for both novice and experienced traders.

Formula for the Bollinger Bands %B Indicator

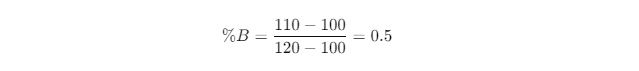

To calculate %B, you use the following formula:

This formula normalizes the current price relative to the Bollinger Bands’ range:

- 0: Price is at the lower band.

- 1: Price is at the upper band.

- 0.5: Price is at the middle band (usually the 20-period SMA).

- Values > 1 or < 0: Indicate extreme price movements beyond the bands.

Practical Example

Imagine a stock with the following values:

- Current Price: $110

- Lower Band: $100

- Upper Band: $120

Here, the price is precisely at the middle band, reflecting neutral market conditions.

When and How to Use the Bollinger Bands %B Indicator

The %B indicator has multiple applications, making it a valuable addition to your trading toolkit. Below are the main scenarios where %B excels:

1. Identifying Overbought and Oversold Conditions

The %B indicator simplifies the detection of price extremes:

- Overbought: When %B rises above 1, the price is near or above the upper band, signaling overbought conditions and potential reversal risk.

- Oversold: When %B drops below 0, the price is near or below the lower band, suggesting oversold conditions and a potential rebound.

2. Analyzing Volatility

%B offers critical insights into market volatility:

- High Volatility: When %B moves rapidly, it often precedes significant breakouts.

- Low Volatility: When %B flattens, it indicates consolidation, typically before a breakout.

3. Confirming Trends

In trending markets:

- During an uptrend, %B consistently stays above 0.5.

- In a downtrend, %B remains below 0.5.

Pro Tip: Combine %B with moving averages or trendlines to improve your accuracy when confirming trends.

Can the Bollinger Bands %B Indicator Be Used Alone?

While %B is a versatile and straightforward tool, it has limitations when used in isolation. Here’s why:

Drawbacks of Using %B Alone

- Volume Insights Missing: The %B indicator doesn’t account for trading volume, a key factor for confirming the strength of price movements.

- Momentum Weakness: %B doesn’t measure momentum, which is critical for assessing the sustainability of trends.

- False Signals: Low-volatility markets can cause misleading %B readings, potentially leading to poor trade decisions.

Combining %B with Other Indicators

To improve reliability:

- RSI (Relative Strength Index): Use RSI to validate overbought or oversold conditions identified by %B.

- MACD (Moving Average Convergence Divergence): Add momentum analysis to %B signals.

- Volume Indicators: Confirm price moves with volume spikes to reduce false signals.

Step-by-Step Guide to Trade with the Bollinger Bands %B Indicator

Here’s how to effectively trade using the %B indicator:

1. Set Up the Indicator

- Apply Bollinger Bands to your chart with the default settings: 20-period SMA and 2 standard deviations.

- Add the %B indicator for enhanced clarity.

2. Monitor for Signals

- Look for %B crossing key levels (above 1 or below 0).

- Pay attention to sustained movements near extremes to confirm trends.

3. Confirm Signals

- Use complementary indicators like RSI or MACD to verify signals.

- For example, an overbought signal from %B is stronger if RSI also indicates overbought conditions.

4. Enter Trades

- Long Position: Enter when %B drops below 0 and begins to rise.

- Short Position: Enter when %B exceeds 1 and starts to fall.

5. Set Risk Parameters

- Place stop-loss orders beyond Bollinger Bands to minimize losses.

- Use the bands themselves as profit targets or trailing stop levels.

6. Review and Adjust

- Continuously monitor the trade and adapt your strategy as needed.

Pro Tip: Backtest your %B strategy on historical data to refine your entry and exit points.

Examples for Bollinger Bands %B Indicator in Action

Example 1: Breakout Trade

A stock consolidates near the middle Bollinger Band with low volatility. Suddenly, %B spikes above 1, signaling a breakout. The trader enters a long position with a stop-loss below the lower band. As the price surges, the trade becomes profitable.

Example 2: Reversal Trade

%B falls below 0, indicating oversold conditions. Simultaneously, RSI shows a bullish divergence. The trader enters a long position, and as %B returns to 0.5, the price recovers, yielding profits.

Example 3: False Signal Management

In a low-volatility market, %B crosses above 1 but fails to sustain its breakout. The trader avoids entering by waiting for confirmation from volume spikes, avoiding a potential loss.

Pro Tip: Document your examples and outcomes to identify patterns in your trading performance.

When Can You Turn a Profit with Bollinger Bands %B Indicator?

1. Trending Markets

- In an uptrend, focus on %B holding above 0.5, indicating strong bullish momentum.

- In a downtrend, %B below 0.5 confirms bearish dominance.

2. Ranging Markets

- Sell when %B exceeds 1.

- Buy when %B drops below 0.

3. Volatility Breakouts

Sudden spikes in %B often precede major breakouts. By trading in the direction of the breakout, you can capture significant price movements.

4. Multi-Timeframe Analysis

Using %B across multiple timeframes enhances your decision-making:

- Higher Timeframe: Identify the overall trend.

- Lower Timeframe: Pinpoint precise entry and exit points.

Enhancing Results with Risk Management and Backtesting

Risk Management

- Position Sizing: Risk no more than 1-2% of your capital per trade.

- Stop-Loss Placement: Place stops beyond Bollinger Bands to avoid premature exits.

- Take-Profit Strategy: Use the bands or volatility levels to set realistic profit targets.

Backtesting Your Strategy

- Test your %B-based strategy on historical data.

- Adjust parameters like moving averages, timeframes, or standard deviations based on asset characteristics.

Pro Tip: Regularly evaluate and refine your strategy to adapt to changing market conditions.

Conclusion: Mastering the Bollinger Bands %B Indicator

The Bollinger Bands %B indicator is a versatile and powerful tool that simplifies complex market dynamics into a single, actionable metric. By measuring the price’s position within the Bollinger Bands, traders can quickly identify overbought and oversold conditions, confirm trends, and anticipate breakout opportunities. Its ease of use makes it accessible for beginners, while its adaptability makes it indispensable for advanced traders.

However, like any technical indicator, %B is not infallible. It works best when combined with other tools such as RSI, MACD, or volume indicators to confirm signals and reduce the risk of false positives. Incorporating sound risk management practices—like setting stop-losses and properly sizing positions—can further enhance your success rate.

Ultimately, the %B indicator can significantly improve your trading decisions if used with a well-rounded strategy. Consistent practice, thorough backtesting, and continuous learning are key to mastering this tool. By leveraging the %B indicator alongside other proven techniques, you can confidently navigate the complexities of the financial markets and work toward achieving consistent profitability.

Bollinger Bands Overview: Link to an authoritative page like Investopedia’s Bollinger Bands article for readers who want a deeper understanding of Bollinger Bands and their applications.

John Bollinger’s Official Website: For readers seeking further details on the technical aspects and strategies, link to John Bollinger’s official site.

Combining Indicators: For a guide on combining Bollinger Bands %B with other indicators like RSI or MACD, link to resources like StockCharts.

Real-World Trading Examples: To provide real-world case studies, you can link to sites like BabyPips that offer practical trading examples.

Terms and Conditions

Educational Purpose

The content provided in this article is intended for informational and educational purposes only. It does not constitute financial, investment, or trading advice.

Learn how to use the Balance of Power (BoP) indicator to master trend analysis, spot reversals, and refine your trading strategy.