Learn how to use the Commodity Channel Index (CCI) effectively. Discover strategies, examples, and tips to improve your trading results today!

Introduction: Unveiling the Commodity Channel Index (CCI)

What is the Commodity Channel Index (CCI)?

The Commodity Channel Index (CCI) is a versatile momentum-based technical indicator. It measures the deviation of an asset’s price from its average price over a specified period. While originally designed for commodities, traders now use it across various markets, including stocks and forex.

- Key Purpose: Identify overbought and oversold conditions.

- Benefits: Spot trends, reversals, and divergences in price movements.

- Common Use Cases: Trend trading, range-bound strategies, and divergence analysis.

For more details, you can check this CCI guide.

Why Are Technical Indicators Important in Trading?

Technical indicators simplify market analysis by converting price data into actionable insights. The CCI is just one example, offering traders:

- Trend Identification: Spot long-term and short-term trends.

- Timing Opportunities: Identify ideal entry and exit points.

- Data-Driven Decisions: Minimize emotional trading by following objective signals.

By combining technical indicators like CCI with other tools, you can build a robust trading strategy.

Goals of This Guide: Mastering the CCI Indicator

This guide aims to help you:

- Understand the purpose, formula, and history of the Commodity Channel Index.

- Apply the CCI effectively in live market conditions.

- Profit from identifying overbought/oversold levels and trend reversals.

Through actionable tips, examples, and risk management strategies, you’ll gain the confidence to trade smarter with CCI.

Formula for the Commodity Channel Index (CCI) Indicator

3.1 The Formula for CCI

The Commodity Channel Index (CCI) is calculated using this formula:

Each component of the formula is critical for understanding how the indicator works:

Typical Price (TP): Represents the average of the high, low, and closing prices:

his ensures a balanced view of price movement.

Simple Moving Average (SMA): The average of the typical prices over a set period.

It smooths out price data to highlight trends.Mean Deviation: The average absolute difference between the typical price and the SMA.

It measures the volatility or price dispersion around the average.

For more details, visit this CCI breakdown.

.2 Example Calculation for the Commodity Channel Index

Let’s calculate the CCI using a 5-day period as an example:

Step 1: Calculate the Typical Price for each day:

Step 2: Find the SMA of the Typical Prices:

Step 3: Compute the Mean Deviation:

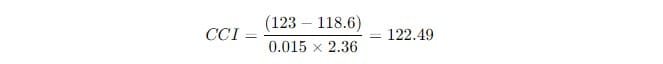

Step 4: Apply the CCI Formula:

Final Result: The CCI value for Day 5 is +122.49, indicating an overbought condition.

When and How to Use the Commodity Channel Index (CCI) Indicator

The Commodity Channel Index (CCI) is versatile and adapts to different market conditions. Its effective use depends on understanding the context and timeframe.

4.1 Key Usage Scenarios for CCI

Trending vs. Ranging Markets

The CCI performs differently in trending and ranging markets:

- In Trending Markets: Use the CCI to identify momentum. For instance, a CCI above +100 signals a strong bullish trend.

- In Ranging Markets: CCI helps pinpoint overbought and oversold levels. A CCI below -100 often indicates oversold conditions.

Identifying Overbought/Oversold Conditions

The CCI’s thresholds of +100 and -100 are critical:

- Above +100: Indicates overbought conditions, suggesting a possible reversal or correction.

- Below -100: Suggests oversold conditions, signaling a potential price increase.

Pro Tip: Always combine CCI readings with other indicators for confirmation. Learn more in this CCI usage guide.

4.2 How to Spot Divergence Signals Using CCI

What Are Divergence Signals?

Divergence occurs when price movement and CCI readings diverge, hinting at a potential trend reversal:

- Bullish Divergence: Price makes lower lows, but CCI makes higher lows. This signals a likely upward reversal.

- Bearish Divergence: Price makes higher highs, but CCI makes lower highs. This suggests a potential downward reversal.

Practical Example:

- Bullish Divergence: If the stock price falls to $100 and then $95, while the CCI moves from -150 to -120, a reversal may be imminent.

- Bearish Divergence: If the stock price rises from $50 to $55, while the CCI drops from +120 to +100, a correction could follow.

By analyzing divergences, traders can anticipate shifts in momentum before they occur.

4.3 Timeframe Considerations for CCI

Using the CCI on Different Timeframes

The CCI adapts well to intraday, daily, and weekly trading:

- Intraday Charts: Ideal for spotting quick entry and exit points. Use shorter periods for higher sensitivity.

- Daily Charts: Best for swing traders who want to capture intermediate trends.

- Weekly Charts: Useful for long-term trend analysis and reducing market noise.

Tips for Selecting the Right Timeframe:

- Align your trading strategy with the chosen timeframe.

- Confirm signals from smaller timeframes with larger ones for accuracy.

For multi-timeframe strategies, see this detailed guide.

Can the Commodity Channel Index (CCI) Indicator Be Used Alone?

The Commodity Channel Index (CCI) is powerful, but its standalone use comes with strengths and limitations. Pairing it with complementary tools enhances its effectiveness.

5.1 Strengths of the CCI: Why It Works Well

Simplicity

The CCI uses a straightforward formula, making it easy for traders to understand and apply.

- Key benefit: It identifies overbought and oversold levels efficiently.

- Quick setup: Traders only need price data and a calculator or charting software.

Versatility

The CCI adapts to different markets, including stocks, forex, and commodities.

- It works in trending and ranging markets.

- Traders can adjust the period to suit their strategy, e.g., short-term or long-term analysis.

Effectiveness in Spotting Trends

The CCI’s ability to detect trend reversals makes it a go-to tool for swing and day traders.

For a deeper understanding of its advantages, check this CCI guide.

5.2 Limitations of the CCI: Where It Falls Short

Susceptibility to Noise and False Signals

The CCI is prone to providing false signals, especially in choppy or low-volume markets.

- False overbought signals may appear in strong uptrends.

- Oversold signals can mislead during prolonged downtrends.

Why Pairing with Other Indicators Improves Accuracy

To mitigate its limitations, combine the CCI with other technical tools:

- Relative Strength Index (RSI): Confirm momentum by cross-verifying overbought or oversold levels.

- Moving Average Convergence Divergence (MACD): Use MACD for trend confirmation when the CCI signals a reversal.

Pro Tip: Use volume indicators alongside the CCI to assess the strength of the signal.

Step-by-Step Guide to Trade with the Commodity Channel Index (CCI) Indicator

The Commodity Channel Index (CCI) is a valuable tool for spotting trading opportunities. This guide explains how to identify signals and manage risk effectively.

6.1 Identifying Entry and Exit Points Using CCI

How to Spot Buy and Sell Signals

The CCI helps traders detect overbought or oversold conditions, making it ideal for entry and exit strategies.

- Buy Signal: Look for the CCI crossing above -100 from below. This indicates potential upward momentum.

- Sell Signal: Monitor the CCI crossing below +100 from above, suggesting possible downward pressure.

Example of Buy Signal:

- The price of a stock drops to $50, with the CCI at -120.

- As the CCI moves above -100, it signals a potential buying opportunity.

Example of Sell Signal:

- A stock price rises to $120, and the CCI exceeds +120.

- When the CCI falls below +100, a sell signal emerges.

For more examples, check this CCI trading guide.

6.2 Risk Management with the Commodity Channel Index

Setting Stop-Loss and Take-Profit Levels

Effective risk management is crucial when trading with the CCI:

- Stop-Loss: Set it slightly below the recent low (for buy signals) or above the recent high (for sell signals).

- Take-Profit: Use a fixed risk-to-reward ratio, such as 1:2, or rely on key support/resistance levels.

Adjusting Position Size Based on CCI Signals

Position sizing helps control risk while leveraging opportunities:

- Stronger Signals: When the CCI exceeds +150 or drops below -150, consider increasing position size cautiously.

- Weaker Signals: When the CCI hovers near -100 or +100, reduce position size to limit exposure.

Pro Tip: Combine CCI with volume analysis to confirm signal strength and reduce false entries.

Combining the Commodity Channel Index (CCI) with Other Indicators

The Commodity Channel Index (CCI) is powerful on its own, but pairing it with other indicators enhances its accuracy and reliability.

7.1 Enhancing Accuracy with Multiple Tools

Using RSI for Confirming Overbought/Oversold Conditions

The Relative Strength Index (RSI) complements the CCI by confirming momentum-based signals.

- Overbought Confirmation: If the CCI is above +100 and the RSI exceeds 70, the asset may be overbought.

- Oversold Confirmation: When the CCI drops below -100 and the RSI falls under 30, it validates oversold conditions.

Leveraging MACD to Reinforce Trend Direction

The Moving Average Convergence Divergence (MACD) indicator helps confirm the trend detected by the CCI.

- Bullish Scenario: A rising CCI above -100 paired with a MACD crossover suggests a strong upward trend.

- Bearish Scenario: A declining CCI below +100 with a negative MACD histogram confirms a potential downtrend.

Aroon Indicator for Validating Trend Strength

Combine the CCI with the Aroon Indicator to measure trend strength and duration.

- Strong Uptrend: CCI above +100 with the Aroon Up near 100 confirms robust bullish momentum.

- Weakening Trend: CCI near zero and declining Aroon readings signal consolidation or trend reversal.

For more insights, check this technical indicator guide.

7.2 Multi-Timeframe Analysis with CCI

Aligning Short-Term and Long-Term Trends

Multi-timeframe analysis ensures consistency in trading decisions by aligning signals across different periods.

- Short-Term Trends: Use the CCI on 5-minute or 15-minute charts for intraday trades.

- Long-Term Trends: Analyze the CCI on daily or weekly charts to identify overarching market trends.

Example of Alignment:

- On a weekly chart, the CCI indicates a bullish trend above +100.

- On a daily chart, look for the CCI to cross above -100 for a short-term entry point.

Pro Tip: Confirm short-term entries with long-term trend direction to reduce the risk of false signals.

Advantages and Limitations of the Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) is a powerful tool, but understanding its strengths and weaknesses is essential for effective trading.

8.1 Advantages of the Commodity Channel Index

Versatility Across Markets

The CCI adapts seamlessly to different financial markets, including stocks, forex, and commodities.

- Key Benefit: It works well in both trending and ranging markets.

- Flexible Periods: Traders can adjust the calculation period to suit their trading style (e.g., short-term or long-term).

This versatility allows traders to implement the CCI in various strategies, from scalping to swing trading.

Identifies Momentum and Trend Reversals

The CCI excels at spotting overbought and oversold conditions, helping traders identify potential turning points.

- Bullish Signal: When the CCI crosses above -100, it indicates increasing bullish momentum.

- Bearish Signal: A drop below +100 signals potential bearish pressure.

Pro Tip: Use CCI readings to enter trades early in emerging trends for maximum profit potential.

For more details on CCI’s advantages, refer to this technical analysis resource.

8.2 Limitations of the Commodity Channel Index

Sensitivity to Market Noise

The CCI is prone to generating false signals, particularly in choppy or low-volume markets.

- Overbought Traps: A high CCI reading doesn’t always signal an imminent reversal in strong uptrends.

- Oversold Missteps: Similarly, low readings can persist during prolonged downtrends.

Traders should exercise caution and avoid relying solely on the CCI for decision-making.

Requires Additional Confirmation Tools

The CCI often needs support from other indicators to improve accuracy.

- RSI: Confirms momentum when CCI signals overbought or oversold conditions.

- Moving Averages: Provide additional trend direction confirmation.

- Volume Indicators: Help validate the strength of CCI signals.

Pro Tip: Combine the CCI with trend and momentum tools for more reliable entry and exit points.

Common Mistakes When Using the Commodity Channel Index (CCI)

The CCI is a helpful indicator, but misuse can lead to losses. Avoid these common mistakes to improve your trading performance.

1. Ignoring Higher Timeframes in Intraday Trading

Why Multi-Timeframe Analysis Matters

Traders often focus solely on intraday charts, ignoring higher timeframes that show the bigger picture.

- Impact: Neglecting the overarching trend can result in entering trades against the dominant market direction.

- Solution: Align signals from smaller timeframes with trends observed on daily or weekly charts.

Example:

If the CCI on a 5-minute chart shows a buy signal, confirm it with an uptrend on the daily chart.

Ignoring higher timeframes can lead to premature exits or unnecessary losses. Learn more about multi-timeframe trading here.

2. Overtrading Based on False Signals

Understanding False Signals

CCI often generates signals that may not lead to profitable trades, especially in sideways markets.

- Example of Overtrading: Entering every time the CCI crosses above -100 or below +100 without considering market context.

- Solution: Combine the CCI with volume or trend indicators to filter out weak signals.

Pro Tip: Use the Average True Range (ATR) indicator to confirm if market volatility supports the signal.

3. Neglecting Proper Risk Management

Why Risk Management is Critical

Overlooking stop-losses or position sizing can result in significant losses, even when using reliable indicators like the CCI.

- Mistake: Traders often over-leverage, assuming CCI signals guarantee profits.

- Fix: Set stop-losses at recent highs/lows or use a percentage of your trading capital.

Example:

If the CCI suggests a buy and your risk is 2% of your capital, position size accordingly to protect against large losses.

Advanced Trading Techniques Using the Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) becomes even more powerful when applied with advanced trading strategies. Here’s how you can elevate your trading game using CCI.

10.1 Customizing the CCI for Sensitivity

Adjusting the Default Period (14)

The standard CCI calculation uses a 14-period timeframe, which offers a balanced approach. Customizing this period alters the indicator’s sensitivity.

- Short-Term Applications: A smaller period (e.g., 7) increases sensitivity, making it ideal for intraday trading.

- Benefit: Captures more signals for quicker entries and exits.

- Risk: Increased sensitivity may lead to more false signals in volatile markets.

- Long-Term Applications: A larger period (e.g., 30) reduces noise and emphasizes major trends.

- Benefit: Helps identify strong, reliable trend reversals.

- Risk: Signals may lag, potentially missing early trade opportunities.

Pro Tip: Test different CCI periods on historical data to find the best fit for your trading style.

For deeper insights into customizing indicators, explore this guide.

10.2 Combining CCI with Fibonacci Retracements and Pivot Points

Using CCI to Confirm Fibonacci Levels

Fibonacci retracements are widely used to identify potential support and resistance zones. The CCI enhances this strategy by confirming retracement strength.

- Example:

- A CCI value rising above -100 at a 38.2% retracement level indicates strong bullish momentum.

- Conversely, a drop below +100 at a 61.8% retracement level signals bearish pressure.

Applying CCI with Pivot Points

Pivot points are another effective tool for spotting key price levels. The CCI adds precision by confirming breakouts or reversals.

- Strategy:

- Look for CCI crossing +100 near a pivot resistance level to confirm an upward breakout.

- Similarly, CCI crossing -100 at pivot support validates a bearish reversal.

Pro Tip: Combining CCI with Fibonacci or pivot points improves accuracy by aligning momentum with price action levels.

Case Studies or Historical Applications of the Commodity Channel Index (CCI)

Analyzing real-world examples helps traders understand how the Commodity Channel Index (CCI) performs in various market conditions. Here, we explore case studies that highlight its effectiveness.

11.1 Real-World Examples of CCI Predicting Market Moves

Case Study: Spotting Reversals in the S&P 500

In 2020, the S&P 500 experienced sharp declines during the COVID-19 pandemic. The CCI proved valuable in identifying trend reversals.

- Key Event:

- In March 2020, the CCI dropped below -100, signaling an oversold condition.

- As the market began to recover, the CCI crossed above -100, confirming bullish momentum.

- Outcome: Traders using the CCI captured the recovery rally effectively.

Case Study: Gold Prices During 2021 Inflation Fears

Gold, a safe-haven asset, experienced significant volatility in 2021. The CCI accurately identified overbought and oversold conditions.

- Key Event:

- In August 2021, gold’s CCI crossed above +100, indicating overbought conditions.

- This was followed by a price correction, validating the CCI’s signal.

Pro Tip: Combine CCI signals with volume analysis to enhance reliability in volatile markets.

Explore more market case studies in this CCI resource.

11.2 Lessons Learned from Historical Applications of CCI

Importance of Context

While the CCI provides valuable signals, its effectiveness depends on market conditions.

- Lesson: In trending markets, rely on CCI’s overbought/oversold signals cautiously to avoid exiting profitable trades prematurely.

Combining Indicators

Historical applications show that pairing the CCI with tools like Moving Averages or RSI improves signal accuracy.

- Example:

- During the 2021 bull run in Bitcoin, combining the CCI with RSI validated strong bullish trends.

Pro Tip: Always backtest CCI strategies on historical data before applying them to live trades.

Example for Commodity Channel Index (CCI) Indicator

Practical examples of using the Commodity Channel Index (CCI) help traders understand its application in live market conditions. Below are scenarios to demonstrate buy/sell signals and CCI divergence.

Practical Scenario 1: Buy and Sell Signals in Trending Markets

Using CCI in an Uptrend

- Example:

In a strong uptrend, the CCI crossed above +100, signaling overbought conditions.- Action: Wait for the CCI to drop back below +100 before initiating a short trade.

- Outcome: Prices corrected after the signal, confirming the indicator’s reliability.

Using CCI in a Downtrend

- Example:

In a downtrend, the CCI dropped below -100, indicating an oversold condition.- Action: When the CCI moved back above -100, traders initiated long positions.

- Outcome: The price recovered shortly after, delivering profitable trades.

Pro Tip: Always confirm CCI signals with other indicators, such as Moving Averages, for added accuracy.

Practical Scenario 2: CCI Divergence Example

Bullish Divergence

- Example:

- The price made a lower low, but the CCI showed a higher low.

- Action: Enter a long trade when the CCI crosses above -100, confirming bullish momentum.

- Outcome: The price reversed upward, validating the divergence signal.

Bearish Divergence

- Example:

- The price made a higher high, but the CCI formed a lower high.

- Action: Enter a short trade when the CCI crosses below +100, indicating bearish momentum.

- Outcome: The price declined, aligning with the divergence signal.

Pro Tip: Divergence works best when paired with support and resistance levels for additional context.

Learn more about CCI signals in this resource.

When Can You Turn a Profit with the Commodity Channel Index (CCI) Indicator?

The Commodity Channel Index (CCI) can deliver profitable results when used strategically. Below, we explore how market conditions, risk management, and testing play critical roles in turning a profit.

12.1 Importance of Market Conditions and Timing

Optimal Market Conditions

The CCI performs best in trending or range-bound markets.

- Trending Markets: In a strong trend, use the CCI to identify corrections or pullbacks.

- Ranging Markets: Rely on the overbought and oversold levels of +100 and -100 to time entries and exits.

Timing the Market

Profitability depends on entering and exiting at the right time.

- Example: Entering after the CCI crosses +100 in an uptrend could lead to premature exits. Wait for confirmation signals.

Pro Tip: Avoid using the CCI during highly volatile or choppy markets, as false signals are more frequent.

Learn more about market timing here.

12.2 Role of Risk Management and Consistent Practice

Risk Management

Profitability hinges on managing risks effectively.

- Stop-Loss: Set a stop-loss just beyond the previous high or low.

- Position Sizing: Adjust position sizes based on market volatility and CCI signals.

Consistent Practice

Practice builds confidence in reading CCI signals.

- Demo Trading: Hone your skills by practicing in a risk-free environment before using real capital.

- Continuous Learning: Analyze both successful and unsuccessful trades to refine your approach.

Pro Tip: Risk no more than 1-2% of your capital per trade to sustain long-term profitability.

12.3 Backtesting and Forward Testing for Optimal Results

Backtesting

Evaluate the CCI’s effectiveness by applying it to historical data.

- Benefits: Helps you understand the indicator’s reliability under various conditions.

- Example: Backtesting CCI signals on gold or forex pairs improves strategy confidence.

Forward Testing

Simulate trades in real-time without risking capital.

- Benefits: Fine-tunes your strategy for live markets.

- Example: Use forward testing on demo accounts for better preparation.

Pro Tip: Combine backtesting and forward testing to ensure a robust trading plan.

Conclusion: Integrating the Commodity Channel Index (CCI) into Your Trading Strategy

A comprehensive understanding of the Commodity Channel Index (CCI) helps traders enhance their technical analysis skills. Below is a summary of key points and final advice on using the CCI effectively.

13.1 Summary of Key Points

Versatility and Applications

- The CCI excels in identifying momentum, trend reversals, and overbought/oversold conditions.

- It works well in trending and range-bound markets, provided you adjust strategies accordingly.

Combination with Other Tools

- Pairing the CCI with indicators like RSI, MACD, or Fibonacci retracement levels improves accuracy.

- Multi-timeframe analysis provides additional insights into both short-term and long-term trends.

Risk Management and Testing

- Proper risk management is essential for consistent profits.

- Backtesting and forward testing refine strategies and ensure better market adaptability.

Pro Tip: Use CCI signals in conjunction with reliable entry/exit points for maximum effectiveness.

13.2 Final Advice for Traders

Start Small and Practice

- Begin with demo accounts to practice using the CCI.

- Focus on one market or timeframe initially to build expertise.

Refine Your Strategy Continuously

- Use CCI signals as part of a broader trading plan.

- Combine technical analysis with fundamental insights for a holistic approach.

Stay Disciplined

- Avoid overtrading based on CCI signals alone.

- Always set stop-loss and take-profit levels to manage risks effectively.

Learn more about refining your trading strategy

Use the Choppiness Index to spot trends, avoid overtrading, and improve profits. Ideal for traders at any level!

Terms and Conditions

Educational Purpose

The content provided in this article is intended for informational and educational purposes only. It does not constitute financial, investment, or trading advice.