Learn how to use the Chaikin Money Flow Indicator to confirm trends, spot divergences, and validate breakouts for smarter trading decisions.

Understanding the Chaikin Money Flow (CMF) Indicator: A Guide to Market Analysis

The Chaikin Money Flow (CMF) Indicator is a powerful tool in technical analysis. Developed by Marc Chaikin, it evaluates the flow of money into or out of an asset over a specific period. CMF combines price and volume to identify buying or selling pressure, offering insights into trends and potential reversals.

The CMF oscillates between -1 and +1. Positive values suggest buying pressure, while negative values indicate selling pressure. Traders use the indicator to confirm existing trends, uncover divergences, and gauge market strength.

For instance, a rising CMF alongside price increases supports a bullish trend. Conversely, falling CMF with declining prices confirms bearish momentum.

Key Resources for Deeper Understanding:

Tips for Using CMF Effectively

- Combine CMF with other indicators for better accuracy.

- Look for divergences to detect potential trend reversals.

- Use multiple timeframes for confirmation.

Chaikin Money Flow (CMF) Formula Explained

The Chaikin Money Flow (CMF) formula evaluates the relationship between price and volume to measure money flow. It comprises key components like the Money Flow Multiplier and the Money Flow Volume, combined over a specific period (commonly 21 days). Here’s a detailed breakdown.

Key Components of the Chaikin Money Flow Formula

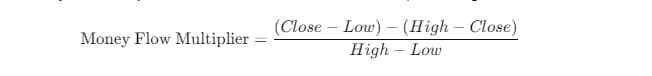

1. Money Flow Multiplier Formula

The Money Flow Multiplier determines if the close is closer to the period’s high or low.

2. Formula

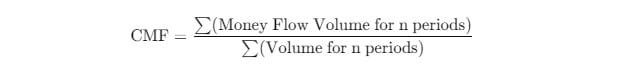

The integrates the multiplier with the volume:

3. Full Formula

The CMF is calculated by summing the Money Flow Volume over a specified period:

Example Calculation

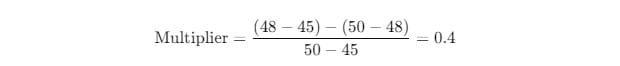

Suppose:

- High = 50, Low = 45, Close = 48, Volume = 10,000

Calculate Money Flow Multiplier:

Calculate Money Flow Volume:

Repeat these steps for 21 periods and sum the Money Flow Volume and total Volume to compute the CMF.

Additional Resources for Learning:

How and When to Use the Chaikin Money Flow (CMF) Indicator

The Chaikin Money Flow (CMF) indicator helps traders analyze market trends, reversals, and breakout validity. It’s a valuable tool for confirming price momentum by combining price and volume data.

Ideal Market Scenarios for Analysis

1. Trending Markets: Confirming Market Strength

In strong trends, a CMF above zero indicates bullish strength, while values below zero confirm bearish pressure.

2. Divergence Scenarios: Detecting Potential Reversals

Divergences occur when the price and CMF move in opposite directions. For example:

- Rising prices with a declining CMF signal potential trend reversals.

- Falling prices with a rising CMF suggest buying momentum.

3. Breakout Patterns: Validating Breakout Strength

The CMF confirms breakouts when accompanied by strong volume. For instance, a positive CMF during a bullish breakout signals genuine buying interest.

Practical Strategies for Using the Chaikin Money Flow Indicator

1. Confirming Trends with CMF

Use the CMF to validate trends. A positive CMF confirms bullish pressure, while a negative CMF supports bearish trends.

2. Spotting Divergences with CMF

Look for discrepancies between price movement and the CMF. For example, falling CMF with rising prices indicates weakening upward momentum.

3. Breakout Validation Using CMF

During a breakout, observe the CMF to assess buying or selling pressure. Higher CMF values strengthen breakout reliability.

Further Reading:

Should You Use the Chaikin Money Flow (CMF) Indicator Alone?

The Chaikin Money Flow (CMF) indicator is a valuable tool, but relying on it alone has limitations. It’s best used alongside other indicators to enhance accuracy and reduce false signals.

Pros and Cons of the Chaikin Money Flow Indicator

Pros:

- Volume-Based Insights: Combines price and volume, providing a more comprehensive view of market pressure.

- Divergence Detection: Helps identify potential reversals through divergences between price and CMF.

- Trend Confirmation: Confirms the strength of trends, especially in high-volume markets.

Cons:

- False Signals in Choppy Markets: CMF can mislead in low-volume or range-bound conditions.

- Lagging Nature: It uses historical data and may not respond quickly to sudden market shifts.

Best Complementary Indicators to Use with CMF

1. Moving Averages for Trend Confirmation

Moving averages smooth price action and confirm the direction of the trend.

2. RSI or MACD for Momentum Analysis

Use the Relative Strength Index (RSI) or MACD to identify overbought or oversold conditions.

3. Volume Profile for Broader Volume Insights

Volume profile offers a detailed view of volume distribution, complementing CMF’s market analysis.

Further Learning:

Step-by-Step Guide: Trading with the Chaikin Money Flow (CMF) Indicator

The Chaikin Money Flow (CMF) indicator is a versatile tool for identifying trends, divergences, and entry/exit points. Follow these steps to trade effectively using CMF.

How to Trade Effectively Using the Chaikin Money Flow Indicator

1. Set the CMF Period Based on Your Trading Style

Use the default 21-period setting for balance or adjust for shorter or longer timeframes to suit your strategy.

2. Analyze Market Context Before Trading

Evaluate the trend and identify key support and resistance levels. This helps ensure CMF signals align with broader market conditions.

3. Identify CMF Signals for Entries and Exits

- Trend Confirmation Signals:

Enter long positions when CMF is above zero and rising.

Enter short positions when CMF is below zero and falling. - Divergence Signals for Reversals:

Look for bullish divergences (price falls, CMF rises) or bearish divergences (price rises, CMF falls).

4. Determine Entry and Exit Points Using CMF

- Entry Points: Enter trades when the CMF crosses above or below the zero line.

- Exit Points: Exit based on predefined risk-reward ratios or when the CMF reverses direction.

5. Place Stop-Loss Orders Strategically

Set stops below recent lows for long trades or above recent highs for short positions to manage risk.

Further Learning Resources:

Chaikin Money Flow (CMF) Indicator Examples for Traders

The Chaikin Money Flow (CMF) indicator offers actionable insights for traders in various market conditions. Here are practical examples of how to use it effectively.

Bullish Trend Example Using the Chaikin Money Flow Indicator

In a bullish scenario:

- The price is in an uptrend, signaling strong market momentum.

- The CMF is above zero and rising, indicating sustained buying pressure.

Trade Setup:

Wait for the CMF to form a higher low during a price pullback. When the CMF starts rising again, enter a long trade to capitalize on renewed momentum. Place a stop-loss below the most recent low to manage risk.

Bearish Divergence Example Using the Chaikin Money Flow Indicator

In a bearish divergence:

- The price forms higher highs, suggesting potential overbought conditions.

- Meanwhile, the CMF makes lower highs, indicating weakening buying strength.

Trade Setup:

Anticipate a trend reversal and enter a short trade when the price confirms the divergence with a downward move. Use a stop-loss above the most recent high to limit losses.

Learn More:

Profiting with the Chaikin Money Flow (CMF) Indicator

The Chaikin Money Flow (CMF) indicator can be a valuable tool for maximizing trading profits. By aligning trades with market trends, spotting reversals, and confirming breakouts, traders can enhance their strategies.

Strategies to Maximize Profits Using the Chaikin Money Flow Indicator

1. Profiting in Strong Trends with CMF

Trades aligned with dominant trends are more likely to succeed. When the CMF is above zero and rising, it confirms strong buying pressure for bullish trades. For bearish trades, a CMF below zero and falling indicates selling pressure. Enter trades in the trend’s direction for higher probabilities.

2. Using CMF Divergences for Reversal Trades

Spot early reversals by identifying divergences between price and CMF. For instance:

- Bullish divergence: Price falls while CMF rises, signaling potential upward reversal.

- Bearish divergence: Price rises while CMF declines, suggesting a downward reversal.

3. Breakouts Confirmed by CMF Volume Analysis

The CMF validates breakouts when volume supports the move. A rising CMF during a breakout indicates genuine buying or selling pressure, increasing the breakout’s reliability.

Risk Management While Trading with CMF

To ensure consistent profitability:

- Use proper position sizing to control exposure.

- Implement strict stop-loss levels to limit potential losses.

- Combine CMF with other tools like moving averages or RSI for higher accuracy.

Advanced Strategies for the Chaikin Money Flow (CMF) Indicator

The Chaikin Money Flow (CMF) indicator provides powerful insights for traders. Mastering its strengths, understanding its weaknesses, and integrating it with advanced strategies can significantly improve trading outcomes.

Strengths and Weaknesses of the Chaikin Money Flow Indicator

Strengths of CMF

- Combines price and volume, offering a more comprehensive view of market dynamics.

- Helps identify trend strength and potential reversals using divergence patterns.

Weaknesses of CMF

- May generate false signals in low-volume or range-bound markets.

- Relies on historical data, making it lagging in nature during rapid market shifts.

How to Identify Divergences with the Chaikin Money Flow Indicator

Bullish Divergence in CMF

Occurs when the price forms lower lows, but the CMF forms higher lows, signaling potential upward reversals.

Bearish Divergence in CMF

Happens when the price forms higher highs, but the CMF forms lower highs, indicating a possible downward reversal.

Multi-Timeframe Analysis with the CMF Indicator

Use higher timeframes to confirm broader trends. Then, switch to lower timeframes for precise entry and exit points. This approach ensures alignment with dominant market directions.

Comparing CMF with Other Volume-Based Indicators

On-Balance Volume (OBV) vs. CMF

While OBV focuses solely on volume direction, CMF incorporates price into its calculations, providing richer insights.

Accumulation/Distribution Line vs. CMF

The CMF offers more dynamic signals by oscillating, while the Accumulation/Distribution Line gives cumulative volume insights.

Avoiding Common Mistakes When Trading with CMF

- Over-relying on CMF: Always combine it with tools like RSI, MACD, or moving averages for higher accuracy.

- Misinterpreting Zero-Line Crossovers: Be cautious in choppy markets where crossovers may produce false signals.

- Ignoring Broader Market Context: Always consider fundamentals and macroeconomic trends alongside CMF analysis.

Frequently Asked Questions (FAQ) About the Chaikin Money Flow Indicator

Get answers to common questions about the Chaikin Money Flow (CMF) indicator, its functionality, and how to use it effectively.

What Is the Chaikin Money Flow Indicator Used For?

The Chaikin Money Flow indicator helps traders analyze buying and selling pressure by combining price and volume data. It is primarily used for:

- Confirming trends in bullish or bearish markets.

- Identifying potential reversals through CMF divergences.

- Validating breakouts with volume analysis.

How Accurate Is the Chaikin Money Flow Indicator?

The CMF is reliable but can produce false signals in low-volume or range-bound markets. Combining it with tools like RSI, MACD, or moving averages enhances accuracy.

Can the Chaikin Money Flow Indicator Be Used Alone?

While it offers valuable insights, relying solely on the CMF may not always yield consistent results. Use it alongside other indicators for better-informed decisions.

What Are the Key Advantages of the Chaikin Money Flow Indicator?

- Combines price and volume for a comprehensive market view.

- Detects trends, divergences, and breakouts effectively.

Conclusion: Is the Chaikin Money Flow Indicator the Right Tool for Your Trading Strategy?

The Chaikin Money Flow (CMF) indicator is a powerful and versatile tool for traders seeking to analyze market trends effectively.

Why the Chaikin Money Flow Indicator Stands Out

The CMF excels in combining price and volume data, providing a holistic perspective on buying and selling pressure. Its ability to confirm trends, spot divergences, and validate breakouts makes it a valuable addition to any trader’s toolkit.

Enhancing CMF’s Effectiveness with Complementary Tools

While the CMF offers robust insights, pairing it with other technical indicators like RSI, MACD, or moving averages enhances accuracy. Such combinations reduce the likelihood of false signals and improve confidence in trading decisions.

Key Takeaways for Profitable CMF Trading

To make the most of the Chaikin Money Flow Indicator:

- Master its signals, including trend confirmations and divergences.

- Always apply disciplined risk management practices, such as setting stop-loss levels and using proper position sizing.

- Adapt the indicator to your trading style and incorporate multi-timeframe analysis for deeper market insights.

Terms and Conditions

Educational Purpose

The content provided in this article is intended for informational and educational purposes only. It does not constitute financial, investment, or trading advice.

Learn how to use Bollinger Bands width for trading. Discover its formula, strategies, and tips to identify trends, breakouts, and maximize profits.